Global Exchange Rate System is Dysfunctional, Inflationary and Volatile since 1971 Nixon Devaluation

Ten-Year U.S. Dollar Bull Market Coming to an End as Fed Approaches Peak of Rate Hike Cycle; Foreign Markets Finally Poised to Beat Wall Street

Welcome to my first post. Thanks for reading. I have been writing about investments and finance since 1992. In 1996, I joined Agora Publishing in Baltimore and a year later, was asked to write for The Sovereign Society, Agora’s international umbrella focusing on global investments, tax, insurance and private banking. Since 1995, I also manage assets for American high net-worth investors in the United States and Europe. I am registered as an Investment Advisor with the SEC.

I love writing. One of my mentors is Bill Bonner, founder of Agora and a successful writer on Substack. Bill is a gifted writer and a provocative thinker. Another mentor is Bill’s late great friend and business associate, Robert Kephart, a giant in the communications industry in the 1970s, 1980s and 1990s, and the single most influential person in my business career. Bob passed away from pancreatic cancer in 2004.

In the spirit of these great mentors and writers, I hope to bring you valuable insight into global investments that are off most investors’ radar screen; your ‘margin of safety’ as an investor will be greatly increased as we plug high value-based investments in the United States and abroad that trade at distressed levels, usually pay attractive dividends, and sometimes, supported by aggressive insider buying. I am also ‘theme oriented,’ seeking disruptive technologies and dynamic management in the growth stock domain. The bear market this year has upended the growth sector, and many great companies are On Sale.

I have been doing this for 30 years, and in most cases, this value-contrarian strategy works. Buy low, sell never, or sell very high. The real big money is made ‘buying and holding’ great companies under the auspices of great management with wide economic moats and strong must-have brands. Day trading etc. is a waste of time for most people, incredibly tax deficient, and expensive. The most successful stock market investors in history made their fortunes buying and holding, not trading.

Let’s shift gears and talk about the accident waiting to happen in the U.S. dollar. You may not realize it now, but a severe depreciation in the U.S. currency will adversely affect your lifestyle, long-term plans, and purchasing power.

U.S. Dollar is too Strong

One of the greatest investment opportunities ahead lies in the inevitable decline of the U.S. dollar. You must be positioned for this outcome because most investors have the bulk of their wealth denominated in dollars; mortgage debt in dollars; life insurance is based in dollars; defined pension plans, SEPs, 401Ks, IRAs — all mostly valued in U.S. Dollars.

I am not quite sure how or when the dollar will decline, but it will happen suddenly. Its incredible rise is distorting capital markets, triggering funding gaps and stressing balance of payments for many smaller nations. Nothing goes up forever. In the financial markets, all trends end. Some violently. The last major U.S. dollar secular bull market started under Reagan in 1981 and by 1985, had skyrocketed vis-a-vis the the deutschemark, Swiss franc, yen etc. The Plaza Accord in 1985 fixed that problem as the G-7 orchestrated the ‘disorderly’ decline of the greenback. The dollar subsequently plunged.

What’s in Your Wallet?

You need to ask yourself one very important question right now: How much of the dollar do you need?

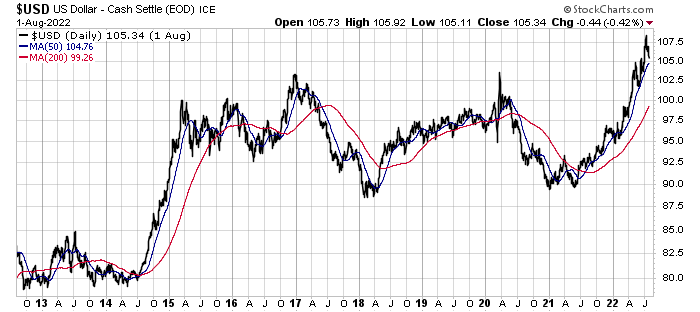

The dollar has been in a secular bull market since late 2011 and soaring against every currency in the world over the past decade. The U.S. Dollar Index (USD Index) recently hit a 20-year high ( see above chart) as the Fed accelerates its rate hike campaign to tamp down surging inflation. The dollar is strong again this year because other major currencies are so weak. On the flipside, the USD Index’s main constituents – the EUR (-11%) and the Japanese yen (18%) – have declined sharply in 2022. It is fair to conclude that this year’s rapid dollar advance has more to do with weak foreign currencies where central banks are trailing the Fed’s interest rate increases. That will change.

So why is the USD so strong? Jim Rogers, one of the greatest global macro investors of our time, once told me in an interview in 1995 that the ‘global exchange rate system is a bunch of drunks with the dollar at the top of the drunkards.’ He believed it had become a dysfunctional monetary regime and doomed to collapse. Inflation has severely compromised the value of fiat exchange rates since Nixon broke the gold standard in August 1971, unleashing another round of high inflation in the 1970s and a massive bull market in real assets like gold, foreign currencies, and commodities.

The dollar remains a ‘safe haven’ currency when risk aversion increases. I have always believed that this is a false premise; the dollar is a ‘liquidity haven,’ as was the case in 2008 when the destruction of credit resulted in a crisis of confidence in the U.S. and the international banking system. It seems hugely ridiculous to me that a currency harboring the most collective debt in the history of the world (last count: U.S. national debt is $30.6 trillion) can be counted as a store of value amid chaos. I suspect the markets will ultimately come to this sobering realization one day in the future when America faces a debt crisis.

By the way, if interest rates continue to ratchet higher and inflation doesn’t decline in the near future, that day of reckoning will arrive sooner because deficit-financing is getting more expensive by the day. High rates will eventually challenge Treasury on interest expense.

Similar Cast, Different Inflation Outcome

Finally, this is not the 1970s all over again. In the 1970s, the main difference, unlike today, is that the dollar collapsed following President Nixon’s closure of the gold convertibility window in August 1971; the effective demise of the Bretton-Woods monetary regime in the 1970s unleashed a torrent of rising prices throughout the decade, worsened by bungled Federal Reserve monetary policies under FOMC Chairman, Arthur Burns. Inflation was already simmering in the late 1960s under the weight of the Vietnam War spending and LBJ’s Great Society bill.

Gold had to skyrocket in the 1970s, along with silver and other commodities because the dollar was no longer a bastion of monetary stability and in gold’s case, its artificially fixed price of $35 an ounce under FDR (enacted in 1934) finally broke. Monetary chaos and high inflation ensued.

I am not in the 1970s inflation camp in 2022. It is a similar cast, but not a replay. The pandemic rattled, and in some cases, broke supply chains, delayed global shipments while massive government stimulus resulted in a boom as consumers went on a buying spree. The real kicker driving the big surge in inflation since last spring is Russia’s invasion of Ukraine, and the resultant surge of commodities prices. Russia is the single largest producer and exporter of commodities in the world. She produces almost every conceivable raw material. And Ukraine, located in Russia’s belly, is the breadbasket of the world.

The Federal Reserve played a big part, too. The Fed and Congress went wild, printing trillions of dollars en masse, triggering inflation.

Also, unlike the 1970s, OPEC is not a driving factor today amid $100 oil. The United States ranks as one of the leading oil and gas producers in the world since 2010 because of shale. But the Biden administration’s quick decision to kill the Keystone XL permit in 2021 and block the expansion of onshore drilling and offshore drilling is hurting the inflation outlook. You cannot have climate change and an energy crisis at the same time threatening your livelihood. There needs to be a mixture of renewables and cleaner fossil fuels to help mitigate the cost burden to households and businesses.

The Endgame

This rally is heavily long in the tooth with the post-1971 average USD bull market rally lasting 5.5 years; we are approaching the 11th year of this advance, and it will end with a crushing blow. Bull markets do not end nicely. They end badly.

My advice to you is to review your U.S. dollar holdings across all of your assets and determine where you can diversify into harder assets like gold, silver, commodities, farmland, housing, and foreign currencies. Also, high quality international stocks denominated in foreign currencies have trailed Wall Street since 2009 by a wide margin in dollar terms. That will change. You want to start buying high quality non-U.S. large-cap dividend stocks in foreign currencies.

If anything, gold should be a ‘safe haven,’ not the dollar and not any other fiat currency, except the Swiss franc. The long held assumption that the American dollar is supreme will be dispelled. Cycles come and go, and the next big shoe to drop is the overvalued dollar.